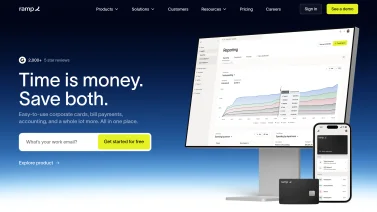

Ramp offers corporate cards and spend management solutions designed to streamline expenses and enhance financial control for businesses.

Ramp Review

Ramp is a comprehensive financial tool that combines corporate cards with advanced spend management capabilities, allowing businesses to gain better control over their expenses. With a focus on automation and efficiency, Ramp simplifies the financial processes for companies of all sizes.

Who It's For

Ramp is ideal for mid-sized to large enterprises looking to optimize their spending practices. It caters to finance teams, CFOs, and operational managers who need a robust solution for expense management and corporate card issuance.

Core Functionality

Key features of Ramp include automated expense reporting, real-time spend tracking, customizable corporate cards, integration with accounting software, advanced analytics on spending patterns, and compliance management tools. These functionalities are designed to streamline financial workflows and provide valuable insights into company expenses.

Business Benefits

Using Ramp can lead to significant ROI through reduced manual accounting work and improved visibility into spending. Companies can expect time savings in expense reporting and enhanced efficiency in financial operations. By leveraging Ramp's analytics, businesses can make informed decisions that ultimately drive cost savings.

Ramp is highly recommended for organizations looking to modernize their financial processes and gain better control over corporate spending.

Key Features

- Corporate cards for easy tracking of employee spending

- Automated expense reporting to reduce manual entry

- Real-time spending insights to enhance financial control

- Customizable spending limits for different teams

- Integrated receipt capture for streamlined documentation

- Budgeting tools to help manage and allocate funds effectively

- Automated reconciliation processes to save time

- Robust analytics dashboard for financial overview and insights

Ramp Use Cases

- Streamlining expense reporting for finance teams.

- Managing corporate card usage across departments.

- Gaining insights into spending patterns for better budgeting.

- Ensuring compliance with corporate spending policies.

- Automating approval workflows for expenses.

Ramp Pros & Cons

- ✓ Simplifies expense management for businesses

- ✓ Enhances visibility and control over company spending

- ✓ Reduces administrative workload with automation

- ✓ Offers a user-friendly interface that is easy to navigate

- ✓ Provides valuable data insights for financial decision-making

- ✗ May require a learning curve for new users

- ✗ Limited availability in certain regions or countries

- ✗ Potentially higher costs compared to traditional expense management solutions

- ✗ Not suitable for very small businesses or startups with minimal needs

Integrations

Pricing

Free trial available

User Reviews

Ramp makes business expenses easy. With texting notifications for purchasing, submit reciepts with a text pic, mark the designated accounts for expeses, and a confirmation of completed transactions. Ramp has made our company spending a breeze. Each department has thier own card to manage spending and budget limits. We should have switched to RAMP sooner. 6 month user

The very MINIMUM they should have done was call me. Furthermore, they should be compensating every job candidate's wasted time for their application project. It is absolutely disgusting how they get away with this dehumanizing behavior.

Frequently Asked Questions

Ramp is a financial management platform that provides corporate cards and spend management solutions. It aims to streamline expense reporting and enhance financial control by offering real-time insights and automated expense tracking for businesses.

Ramp offers a transparent pricing model with no hidden fees. Businesses can expect competitive rates based on their specific needs, and Ramp does not charge annual fees or interest on corporate card balances.

Ramp is best suited for small to medium-sized businesses looking to improve their expense management and financial oversight. It is particularly beneficial for companies that prioritize efficiency and wish to automate their financial processes.

Key features of Ramp include corporate cards with no fees, automated expense tracking, real-time reporting, and customizable spend controls. The platform also offers integration with accounting software to streamline financial workflows.

Yes, Ramp provides potential users with a free trial to explore its features and capabilities. This trial allows businesses to test the platform and evaluate how it can meet their specific financial management needs.

Ramp seamlessly integrates with various accounting and financial management tools, such as QuickBooks and Xero. This integration helps businesses maintain accurate financial records and ensures data consistency across platforms.